If Your Goal is to Buy Low, Buy Now

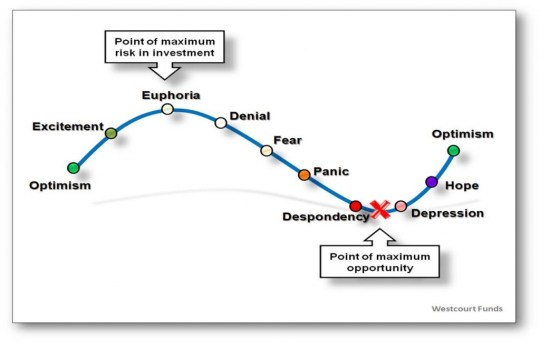

There is a very famous saying which asserts “Sell High, Buy Low”. It is obviously great advice no matter what the investment. Below is a graph showing the cycle of investments. It shows the points of maximum risk and maximum opportunity when purchasing. We want to sell high (point of maximum risk) and buy low (point of maximum opportunity).

The challenge is how to determine when we have hit bottom if you are a purchaser. The only time you can guarantee a bottom is after you pass it.

However, there is more and more evidence that the COST of a home has in fact hit bottom. Notice we have used the word COST. Unless you are an all cash buyer, you must take into consideration the expense of financing a property to determine the true cost of purchasing the home. Interest rates have increased over the last quarter; and the rise in rates has counteracted any fall in prices.

Let’s look at an example:

Let’s say you were going to take out a $200,000 30-year-fixed-rate mortgage in November of 2010. At that time, interest rates were 4.17% (as per Freddie Mac). Your principle and interest payment would have come to $974.54. According to the most recent report from Case Shiller house prices fell 3.9% in the 4th quarter of 2010. The most recent report from the Federal Housing Finance Agency shows a 0.8% fall in prices. Let’s use the larger percentage decrease: 3.9%.

For the sake of keeping the math simple, we will now say you can get the same house with a $192,000 mortgage (4% discount from November price). Interest rates are now 4.95% (as per Freddie Mac).

Your principle and interest payment would now be $1,067.54.

By waiting to pay less for the PRICE of the house, the COST increased $93 a month. That adds up to $1,116 a year and over $33,000 over the life of the loan.

We realize that there are other things to consider (ex. the mortgage tax deduction, etc.). This example is just a simple way to show that there is a difference between COST and PRICE.

Bottom Line

If you want to buy low, buy now. It appears COST has hit its lowest point.

Cheryl Walsh

C. Walsh Realty

www.CWalshRealty.com

www.CWalshConstructionLLC.com

Search for Homes in North Attleboro, Attleboro and the Attleboro areas.